February’s figures held steady at an annual inflation rate of 3.4%, which has been consistent for the last three months. This plateau suggests a pause in the relentless price climbs that have worn out family wallets. Economists caution against celebrating just yet, pointing to the inherent unpredictability of monthly data and if inflation is matching… Continue reading Stable Inflation Rates

Author: Matthew Jones

Navigating Through Economic Headwinds: Australia’s Delicate Balance

Australia finds itself at a critical juncture, grappling with several sizable economic challenges that threaten to disrupt its post-pandemic recovery. The landscape is marked by stubbornly higher inflation figures, potential recession signals, and a closely scrutinised monetary policy. Requiring smart fiscal strategies from the federal government to steer the economy towards stability and growth. Recent… Continue reading Navigating Through Economic Headwinds: Australia’s Delicate Balance

Australian Government’s Tax Reforms Hit Parliamentary Roadblock

In news that will not surprise any readers of this blog, but the federal government’s plan to overhaul the tax system for the offshore gas industry have encountered significant delays in parliament. Indeed, we first spoke about the suite of changes in an article last year. The government wants to modify the Petroleum Resource Rent… Continue reading Australian Government’s Tax Reforms Hit Parliamentary Roadblock

Rising Unemployment, Inflation, and the Potential for Reform

Last week the National Accounts prepared by the Australian Bureau of Statistics were released for the December 2023 quarter. The key points in the report were that the Australian economy rose 0.2% in seasonally adjusted chain volume measures and in nominal terms GDP by 1.4%. The terms of trade grew 2.2%, while household saving to… Continue reading Rising Unemployment, Inflation, and the Potential for Reform

Rising lipstick sales amid economic gloom

When consumers start to feel the pinch from a slower economy, people opt for a smaller treat instead. This could be making your coffee at home, rather than buying a takeaway coffee or buying lipstick instead of a designer handbag. This is better known as the ‘lipstick effect’ and the Australian Retailers Association recently noted… Continue reading Rising lipstick sales amid economic gloom

The Great Australian Dream

Australia has found itself within a well publicised cost of life crisis due to rising food, energy and housing costs that are stretching already frayed family and individual budgets. This issue has expanded to such an extent that it now dominates political discourse, influences demographic trends, and challenges the nation’s economic policies and of course… Continue reading The Great Australian Dream

Elephant in the Room

Shane Oliver has increased his probability of Australia entering a technical recession to 50 %, which means that the Australian economy must experience two consecutive quarters of negative GDP growth. Oliver identifies the key risk of entering recession stems from the lagged impact of mortgage rate rises, which has led to consumer spending falling as… Continue reading Elephant in the Room

The Spanish Solution

The Reserve Bank of Australia has again paused on raising the official cash rate leaving it unchanged from 4.10 %. In his statement on Tuesday the RBA governor Phillip Lowe stated that he expected Australia’s CPI inflation “will continue to decline, to be around 3.5% by the end of 2024.” An observation by senior APAC… Continue reading The Spanish Solution

RBA on hold again

The decision by the Reserve Bank to keep the official cash rate on hold at 4.1 % on Tuesday, suggests that the Bank believes it has lifted them enough after 12 near consecutive rate hikes. They again paused to see if their tightening has started to rein in inflation. At face value their rate hikes have… Continue reading RBA on hold again

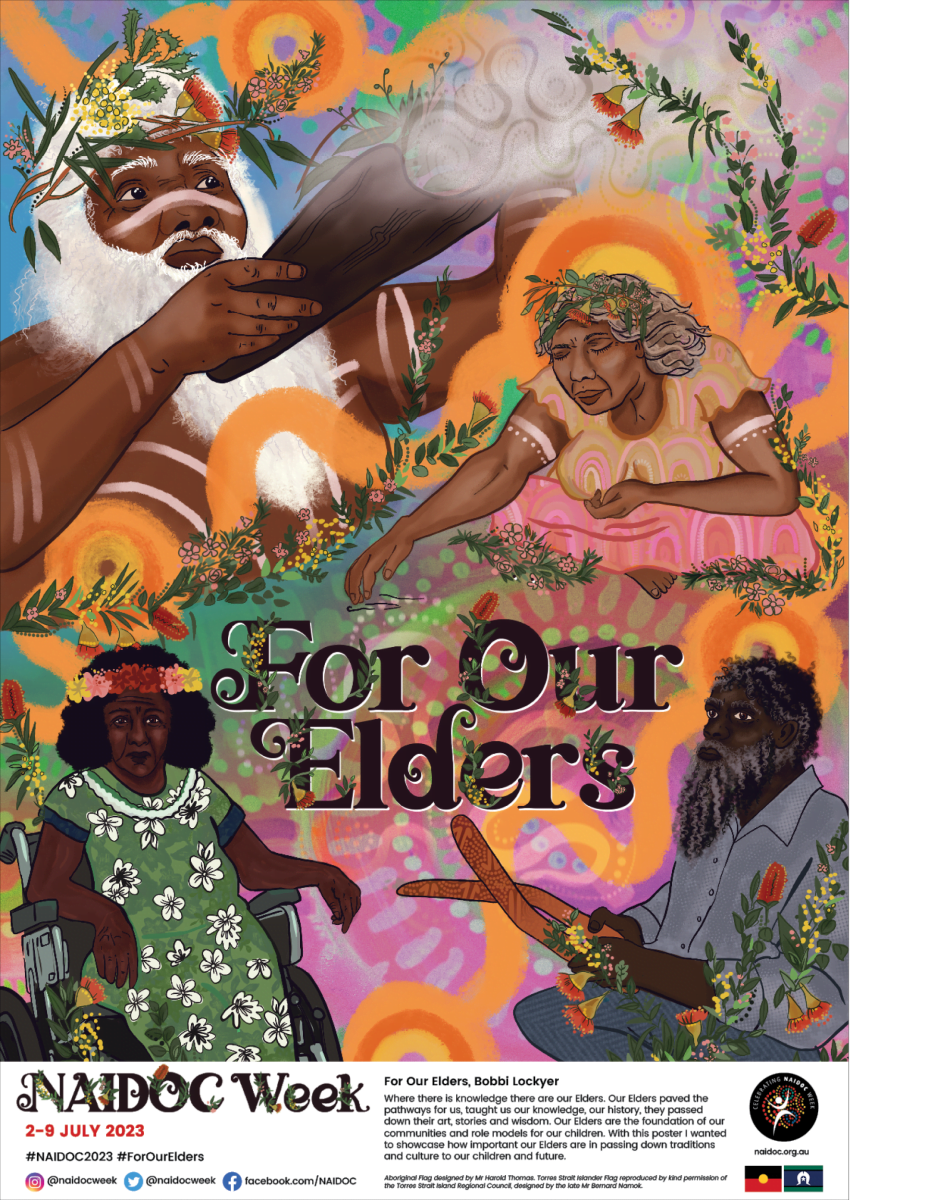

NAIDOC Week

I’ve changed the topic for this week’s article to talk about NAIDOC week, which is a departure from my usual conversation about business. For my international readers and, that’s around 15 % of base. NAIDOC Week happens annually in Australia and celebrates the history, culture, and achievements of Aboriginal and Torres Strait Islander peoples. “NAIDOC”… Continue reading NAIDOC Week