The decision by the Reserve Bank to keep the official cash rate on hold at 4.1 % on Tuesday, suggests that the Bank believes it has lifted them enough after 12 near consecutive rate hikes. They again paused to see if their tightening has started to rein in inflation. At face value their rate hikes have started to bite as growth in the Australian economy had slowed, and labour market conditions have eased, although they remain tight.

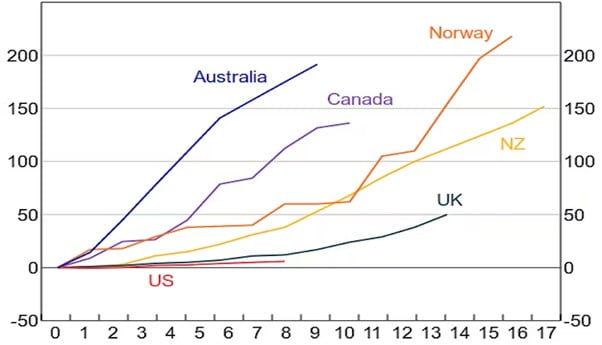

Yet Australia’s increase from close to zero to 4.1 per cent has caused Australian borrowers more pain than borrowers in other countries. For instance, the United Kingdom’s cash rate is at 5 %, the USA at just above 5 % and our cousins from across the ditch at 5.5%.

That’s because an exceptionally large proportion of Australian mortgage holders are on variable rate mortgages at around 70%. Compared to 35 % in Canada, 15 % in the UK, 12 % in New Zealand and fewer than 5 % in the United States.

Back in February, the Reserve Bank’s estimate was that the interest rates actually paid on Australian mortgages had climbed 2 % since it began pushing up rates.

Contrast this with the rates paid in New Zealand climbed by one and a half percentage points, the rates in the UK by half a percentage point, and the rates in the United States have barely moved.

Because mortgages themselves are so much bigger than they used to be, the dramatic increase in rates actually paid costs a lot more than it would have. Modelling by the ANU show that the post tax income devoted to payments has jumped from 17 to 25 %.

Usually, Australians take out fewer fixed-rate mortgages, but this trend changed in 2020 and 2021, when we took out lots with fixed two- and three-year rates to take advantage of relatively low fixed rates.

As many as 880,000 of those fixed-rate terms are about to expire, pushing those borrowers from rates of around 2 per cent to rates nearer 5.5 per cent, or a jump in around $1,000 per month to service the loan. Which is an awful lot of money for stretched households to find to keep a roof above their heads.

The Reserve Bank itself expects 15 per cent of borrowers to find themselves with negative cash flows in the coming months. Which is a fancy way of saying that household income won’t match their outgoings, and they’ll have to run down savings, work more hours, or tighten their belts to make ends meet.

Households are already winding back spending and that runs the risk of bringing on a recession. Something that’s already happened in New Zealand and might happen in the United Kingdom.

That path to avoid a recession for Australia might mean accepting a slower reduction in inflation than some would like, or even a higher end point around 3 % than 2-3 %.

Nobel prize-winning economist Paul Krugman suggested quietly abandoning the US inflation target of 2 %, once inflation dropped to a point where people no longer noticed it all the time. Which he thought would be about 3-4 %.

When we get there, the RBA Governor either Philip Lowe or his successor will have time to think about how important attaining an ultra-low inflation rate of 2-3 % is to the overall economy. If we consider the higher unemployment rate and mortgage defaults that will need for inflation to return to this band.