Shane Oliver has increased his probability of Australia entering a technical recession to 50 %, which means that the Australian economy must experience two consecutive quarters of negative GDP growth. Oliver identifies the key risk of entering recession stems from the lagged impact of mortgage rate rises, which has led to consumer spending falling as the increased living costs chip away at family budgets.

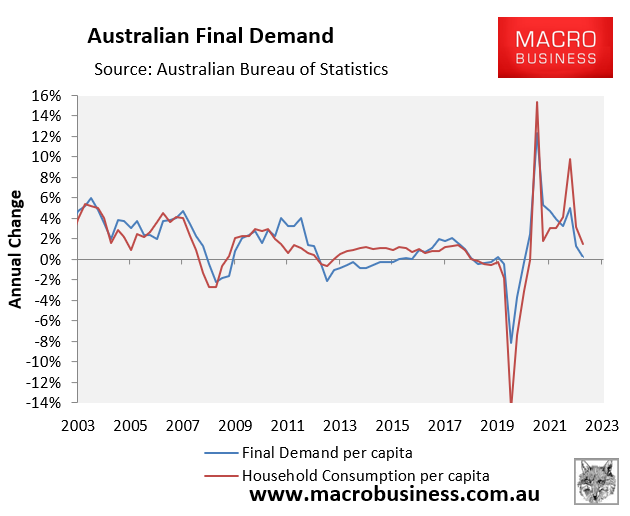

Household consumption is the primary driver of the Australian economy and, as such household spending leads the economy. The link between the two is shown in the graph below taken from Macrobusiness.

Ultimately, the collapse in real household spending, as shown in the chart above, points to falling GDP growth in aggregate and in per capita terms. The severity of the drop in the household consumption and demand per capita trend lines certainly supports Oliver’s opinion. It also strengthens the argument that the RBA has finished their tightening cycle and must now adopt a ‘wait and see’ approach until they need to begin loosening monetary policy sometime next year.

While a technical recession can be avoided due to the Albanese’s government’s record immigration policy, the result is still likely to leave Australians with a smaller portion of the overall economic pie along with a side helping of decreased living standards.