The Reserve Bank of Australia (“RBA”) Board meets tomorrow and, it’s highly likely that the Board will raise the official cash rate by 25 basis points from 3.10% to 3.35%. If we look at the Board’s December decision to raise interest rates, they said the following.

“The Board expects to increase interest rates further over the period ahead, but it is not on a pre-set course. It is closely monitoring the global economy, household spending and wage and price behaviour.”

Developments since the December Statement support a rate increase.

The latest Australian Bureau of Statistic (“ABS”) Retail report showed retail sales fell by 3.9% in December following a 1.7% increase in November. Unadjusted retail sales still rose in December – by 16% – but not by the usual 20% adjustment.

The challenge here is that the increasing popularity of Black Friday sales in late November, is permanently shifting consumer behaviour by bringing forward purchases that would usually occur in December. However, this shift can only be confirmed over time. Until then, seasonal adjustments will tend to overstate ‘underlying’ strength in November and understate December performance.

There’s a large asterisk next to the December results as the ABS excludes a wide range of spending, including many segments that most people think of as ‘retail’. They don’t include pubs and bars, hotels and accommodation, motor vehicles, and fuel. Along with movies, theme parks, telecommunications, travel, and other services such as health and education.

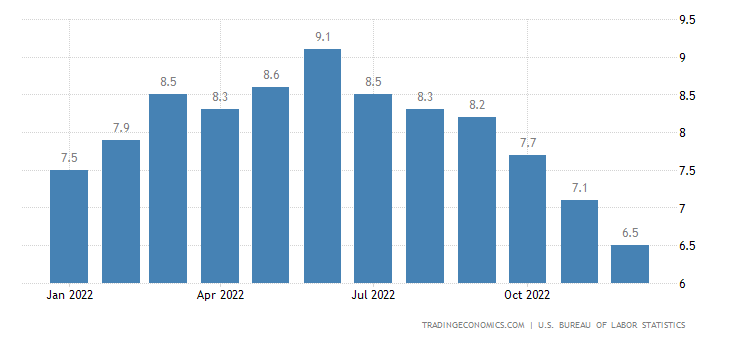

There are also several positive international factors that the RBA will take into consideration tomorrow. With the unexpected rapid reopening of China; a mild European winter with associated lower energy prices; and reasonable expectations that the US Federal Reserve is nearing the end of its tightening cycle. Further, the US Federal Reserve’s attempts to control inflation has started to impact on inflation growth rates.

Source: US Bureau of Labor Statistics

However, the RBA Board will still be cautious around the December retail results. It will not base its decision on a single month’s dataset, particularly given the issues noted above. It is likely to want to have a firmer grasp of seasonal adjustments and to get a better assessment of wider consumer spending in the December quarter national accounts. These datasets are available from 1 March and will be avidly reviewed by the RBA mandarins prior to the March meeting.

There is evidence that some supply-side inflation pressures are easing in Australia, but service inflation continue to rise. While that increase will partly be driven by demand, it is also consistent with the idea that Australia’s wages cycle lags the US. While wage inflation is easing in the US, the opposite holds true in Australia with building wage pressure.

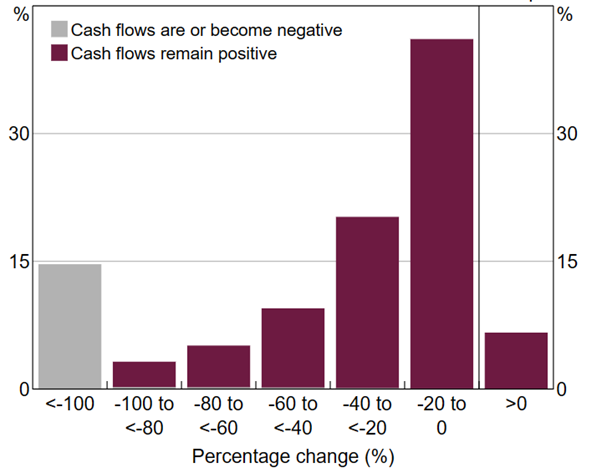

The fly in the ointment amongst all of this is the lagging impact on consumer spending from interest rate rises. Indeed, the RBA modelling of the impact on household spending from an official cash rate of 3.6% found that over half of households would experience a reduction in spare cash flow of 20%. While 15 % would have their spare cash flow turn negative immediately or to say it a different way. They wouldn’t have enough money to pay for their mortgage before they even considered buying essential items like food.

Source: Reserve Bank of Australia

With that in mind, it seems likely that Governor Philip Lowe will maintain his December position, namely that “The Board expects to increase rates further over the period ahead, but it is not on a pre- set course”. This allows the Governor desire to hedge their bets, while the Bank strives to return inflation to the 2 – 3 % band.

Overall, we expect that the Bank will follow a 25-basis point hike tomorrow with another in March and then potentially hold in April. Waiting until the March quarter inflation report is prepared and, depending upon the result the RBA would hike again in May. However, the RBA’s internal modelling should give them pause sooner rather than later to pause on further cash rate rises.

Until inflation returns to the target band or the Australian economy tips into recession, which might come because of the RBA’s tightening cycle.