The Federal government announced on Friday, 9 December that they intended to introduce legislation to impose a cap on coal and gas prices. Something that will be welcome news to most Australian households, that are feeling the squeeze from high interest and inflation rates.

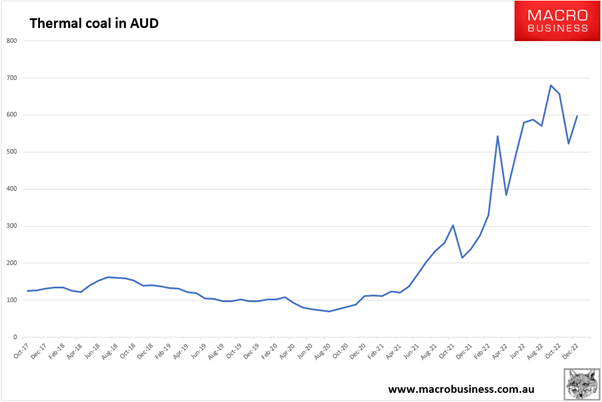

A price cap simply establishes a rate or price to be paid for a good or service. In this case the federal government intends to impose a $125 per tonne price cap on Thermal coal being sold into the Australian domestic market. This ensures that coal, which currently sets the price on the eastern seaboard, is lowered to the price cap and this reduces the retail prices paid by consumers. A simultaneous cap on the wholesale price of gas would also be implemented at or around $12 per gigajoule.

Apparently, the key sticking point in the negotiations between the Federal government and the Queensland and New South Wales state governments was around the potential compensation that would need to be paid to the states for lost royalties and to the coal producers.

With the coal spot price above $600 per tonne, a $125 price cap would have a material impact on the Queensland and New South Wales in foregone royalties. A price cap established at this rate in conjunction with a price cap on wholesale gas prices, would also go a long way to restoring energy prices to their prewar rate. Given the recent announcement it appears a deal has been struck at the national cabinet meeting, and this is positive news for the country.

Although, we will have to wait for further detail to emerge about the package surrounding price caps and their impact on the marketplace. Will it impact existing long-term contracts, and will there be a sunset period imposed upon the price caps?

If the federal government did nothing and allowed the coal & gas market dysfunction to continue, the average eastern seaboard electricity bill of around $1,600 per annum would jump to around $5,000 to $6,000.

Which would contribute to higher inflation and, force the RBA to further raise interest rates to dampen consumption. The flow on effect of higher interest rates will continue to impact on Australia’s national pastime of purchasing properties. By lowering the amounts that banks will lend to purchase property and making it that much harder for people to pay their mortgages. Either way Australian households have flagged a smaller Christmas period given their subdued consumer sentiment in the recent Roy Morgan poll.

The Opposition under Peter Dutton has flagged their resistance to the imposition of price caps, which is curious given the hip pocket relief that it will grant Australian households.

However, in an earlier interview today on Channel Nine, Mr Dutton indicated that he supported an increase in the supply made available to the domestic market by Shell, Origin and Santos. Which would also act to drive down prices and, provide a competitive advantage to Australian businesses.

This is an excellent course of action to undertake over the medium to long term, however pursuing this option alone is unlikely to lower energy prices in the short term. Which given the severe stress that most Australian households are experiencing, any solution must include an interim step to provide some immediate relief.

Further, the government could seek to restore a Super Profits tax and to impose a ‘use or lose it’ legislation, to prevent companies from sitting on energy assets that could be brought to market to address the energy shortfall. However, the Labor government is apparently still scarred from the incredibly effective anti-Mineral Resources Tax campaign conducted by the resources sector during the Rudd & Gillard years. So, I suspect that both potential policies will remain on the shelf for the time being.

Let us hope that in the spirit of Christmas cheer, that a long term and sustainable agreement can be reached with all parties.