The relentless monetary tightening cycle by the Reserve Bank of Australia continued, despite economic growth groaning under the strain of prior hikes. Much like the Maroons piling on the pressure on the Blues in the State of Origin on Wednesday night.

The economy is demonstrating classic signs of reaching a tipping point and a policy misstep at this stage of the cycle can have a dramatic economic impact.

More concerning to us, since the Maroons winning another series is simply an excellent result, is that the RBA has shifted the goal posts again. As the commentary in their released minutes seemingly justify another one or two interest rate hikes over the coming six months.

The RBA now believes that the causes of inflation are due to excess unit labour costs and poor productivity growth. Which means that the RBA believes the real problem driving inflation is that we are just not working hard enough.

The Governor even suggested that people struggling under cost-of-living pressures might want to take up a second job. Something that he was rightly criticised for by the public and sections of the media.

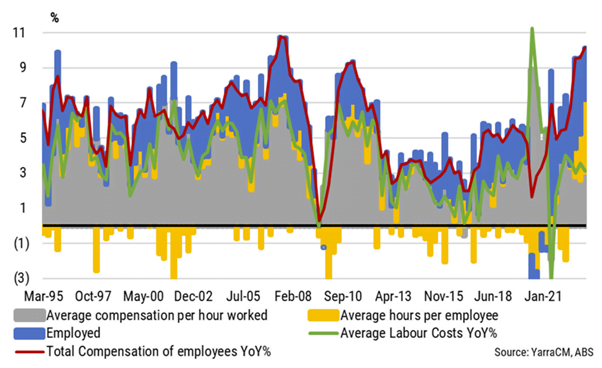

The RBA’s main inflation model is heavily weighted to the movement in unit labour costs and, to a lesser degree, the change in the unemployment rate. The broadest measure of labour costs is total compensation of employees from the National Accounts and is quite strong expanding at 10% year on year.

This is shown in the Chart below prepared by Coolabah Capital using ABS data.

Compensation of Employees and Average Labour Costs

Two things stand out to us at first glance.

Firstly, employment growth has been strong and has been a key reason for the growth in the total wage bill, but it is already starting to slow. Job advertisements are slowing and rising job applicants per job ad suggest that labour demand is easing relatively quickly, while the labour supply rises sharply due to the Federal Government’s record migration levels.

Expect the unemployment rate to climb higher in coming months.

Secondly, hours worked rose an impressive 7.2% year on year, while hours worked rose by 3.3% year on year. Contrary to the Governor’s assessment that Australian’s aren’t working hard enough, we are currently working harder than ever!

On a per capita basis the economy has shrunk over the past six months and the data for the June quarter suggests that worse growth outcomes lay just around the corner. This slowdown has come about due to the RBA’s tightening cycle combined with the Government’s attempt to get out of the RBA’s way by trimming spending.

If we continue to raise interest rates because of a short-term productivity fall, then we are caught in a doom loop of faltering productivity and higher interest rates.

In their recent interest rate decision, the RBA also referred to rising services inflation overseas, house prices and a weak AUD as additional reasons for hiking. With the federal government running a massive migration push, house prices will largely take care of themselves regardless of mortgage costs. While the AUD has remained relatively steady.

Our key concern is that consumption trends are already slowing markedly, so a sustained rise in house prices only minimally impacts upon demand in 2023-24. Indeed, both consumption and housing finance are trending beneath expectations.

We maintain that the RBA should have already finished the hiking cycle, but as they have openly shifted their goal posts about the causes of inflation, makes it likely that a further hike or two occurs.

Until central banks come to their senses and realise that incremental interest rates hikes at this stage of the cycle, when demand is already slowing, risks a painful and very hard landing for the economy in the second half of the year.