After a record 350 basis points of rate increases, the Reserve Bank of Australia on Tuesday wisely paused their monetary policy tightening cycle at 3.6 per cent. A position that we predicted that the RBA would take in an earlier post. This level also matches their internal scenarios that suggested about 1 in 7 Aussie borrowers, at the current cash rate, are underwater or paying more than they earn to keep a roof over their head.

Most hope that this is the end of the tightening cycle, the bond markets are acting like that is the case. It’s a similar story in the US where their bond market is pricing in only half of one future interest rate increase by the Federal Reserve. Then apparently pricing in the Federal Reserve to start cutting interest rates by about 100 basis points from January 2024.

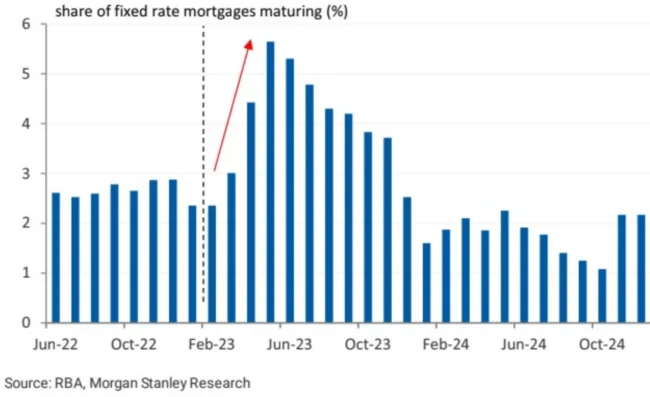

A second tightening cycle would be horrific for individuals and companies that structured their long-term financing upon continued access to low-cost funding, and we already discussed the mortgage cliff facing Australian households rolling from low fixed rate mortgages established during the pandemic to current interest rates. For some households this involves their repayments doubling, something that many will struggle to accommodate within already stretched family budgets.

However, central banks remain committed to breaking the back of high inflation. Which suggests that the RBA will pause and then embark on another tightening cycle. This scenario has occurred during 2009 to 2010 the RBA lifted its cash rate from 3 per cent to 4.75 per cent and then paused for five consecutive meetings in 2010. If we go further back between 2002 to 2008 the RBA raised interest rates from 4.25 % to 7.25 per cent and had three pauses of 12 months or more.

Higher interest rates, combined with high inflation contributing to elevated cost of living and increased supply chain costs have impacted the consumer and companies alike. Consequently, local insolvencies particularly in the building sector have spiked since the start of the year with Porter Davis and Lloyds Group being the most recent examples.

Why the RBA will continue lifting interest rates.

With the increased cost of debt funding being experienced by companies and consumers, why would the RBA continue to lift interest rates? Previous monetary policy tightening cycles involved higher interest rate settings leading to a sharp rise in unemployment levels beyond full employment. A trend referred to as the ‘nonaccelerating inflation rate of unemployment’ or NAIRU.

However, some analysis of the cycle argue that the current RBA cash rate of 3.6 per cent is only just above the neutral cash rate of 3.5 per cent. This is a position advocated by the Coolabah Capital & if you haven’t read their papers, I’d recommend that you take the time to do so.

While the full-time unemployment rate rests at 3.5 per cent, which is beneath the RBA’s assessed NAIRU of low 4 per cent range. Underlying inflation has eased during the first quarter of 2023, it remains above the RBA’s targeted 2 – 3 percent band and is expected to do so until 2025. This could lead to employees or business increased their prices or wages to counteract the expected inflation increase leading to a wage – price spiral.

The possibility of a wage price spiral has remained remote in recent times, but wage pressure could build further if the Fair Work Commission delivers a large increase in the minimum wage combined with state governments relaxing their salary caps. These factors are included in the RBA’s inflation models and unless there is a further expansion in productivity likely to strengthen the decision to raise interest rates further.

The RBA touched on this point in its press release during the week, highlighting that current wages growth would only be “consistent with the inflation target … provided that productivity growth picks up”.

To reduce the increased inflation, pressure the federal government has embarked upon a record migration program to expand the labour pool, which in turn reduces the ability for employees to bargain for higher wages. It also leads to an expansion in the business sector as the greater population requires access to housing, utilities, and food.

Finally, Australian households are apparently sitting on large cash buffers estimated to be around 20 per cent of annual household income. Which is one reason for the resilience of spending despite record interest rate rises. If households continue to use this funding to prop up spending, then it might be harder for the RBA to bring inflation under control without raising interest rates further. With that in mind, I expect that the RBA will pause on further interest rate rises, before continuing to hike interest rates in the coming months.