This week the Reserve Bank Board’s minutes were released from their meeting on Tuesday, 7 March. One of the key points from the meeting was that the Board only considered the case for a 25-basis point increase, discarding both holding interest rates or a 50-basis point increase.

The minutes noted that “Members agreed to reconsider the case for a pause at the following meeting, recognizing that pausing would allow additional time to reassess the outlook for the economy.”

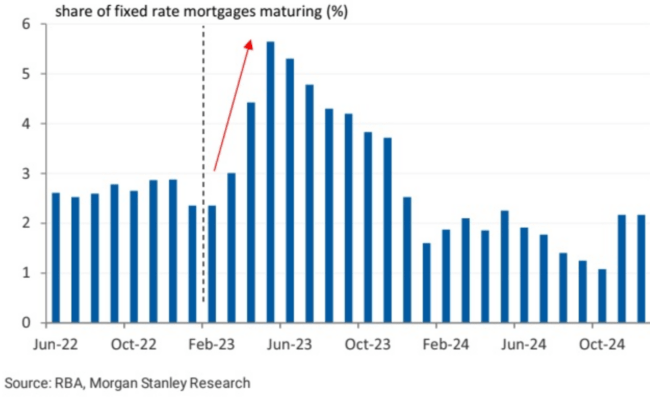

Which reflects that the data around GDP, labour market, wages and inflation were all softer than expected. This trend is likely to continue when we take into consideration the large number of cheap fixed rate loans due to expire from April onwards, the same households that were told to expect that there would be no interest rate rises until 2024.

Clearly the Board takes market pricing into account. At the time of the Board meeting market pricing supported the view that, in the case of the RBA, nearly 75 more basis points of tightening were likely to follow the March meeting. Now that pricing has fallen away completely.

Similarly on international markets the Minutes refer to, “Market participants’ expectations of the path of policy rates in advanced economies had shifted up since the previous meeting.” Now, market pricing and this blog is predicting a series of rate cuts over the course of 2023.

Recent global market volatility poses some downside risk to the economic outlook for Australia via the potential impact on world growth, bank funding costs, confidence, and the lending practices of the local subsidiaries of global banks. However, the RBA has an information advantage over the market through its access to APRA’s bank lending standards survey.

The exact effect is hard to quantify and might be partly offset by a lower exchange rate, although the market has factored in a substantial impact as it now prices in rate cuts. Which rests on the implicit assumption that further financial instability evolves into a world financial crisis.

The abrupt switch in market pricing from rate hikes to rate cuts seems an overreaction at this stage, particularly when central banks have developed a larger policy toolkit in the wake of the global financial crisis and with an immediate and aggressive policy response to the financial volatility to date.

Although not mentioned in today’s minutes, the RBA review panel provides its recommendations to the treasurer on 31 March, which the advice should come as no surprise to him given he has said that he is in close contact with the panel.

The treasurer has said that he will provide the government’s initial response to the recommendations by the mid-May budget.

Overall, the minutes illustrate that there is a large degree of uncertainty around the global financial markets with the collapse of Silicon Valley Bank and two other regional banks. The acquisition of Credit Suisse by UBS AG and the potential for a credit crunch.

While the Board will still be uneasy at the elevated nature of inflation and, they will still want to restrain that further. With all these factors in mind it is likely that the RBA will pause in April and then hike again in May once more information is at hand.