Conventional business logic or what I learned at MBA school is that when you start something new, you first create a ‘Minimal Viable Product’ or MVP. Which means that you create a product that just ‘gets the job done’. It also means that the first version of your product is usually sold at a comparatively low starting price, both to compensate for its lack of features, and to generate market share at launch.

Some organisations take this concept even further and launch the first version of their product completely free of charge. With a plan to ‘monetise’ the product later once they’ve added more features and are confident that people will be willing to pay for their product. This is a popular option for online game creators such as Minecraft or Roblox.

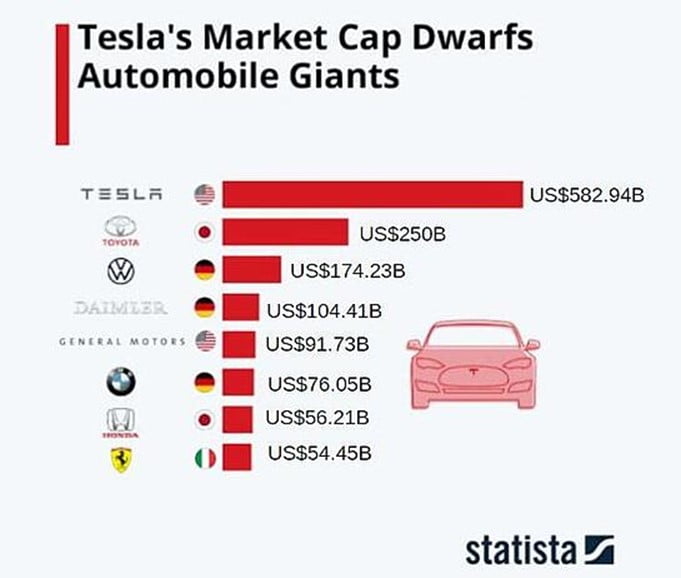

Tesla announced that their organisational goal was to be the biggest car company in the world, which was a bold statement given the competition from established giants such as Honda, Toyota, General Motors to name a few. Their research revealed that to become the biggest carmaker by volume, would traditionally involve an operational plan to dominate the lower-end consumer car market or cars that retail for around $45,000 (AUD) to buy.

They also decided to pursue an electric vehicle, since going green was appealing to many consumers. The other factor was the convenience of being able to charge at home or at a charging station and also avoiding record high fuel prices at the bowser.

Rather than start with the affordable market and sustain rapid growth by pushing down their overhead costs through economies of scale. Tesla flipped things on their head by creating the most luxurious, expensive, fully featured sports car that they could produce. That car was the Tesla Roadster, and the newest base model Roadster retails from $260,000 (AUD). This was the first car that Tesla ever produced, despite not knowing if they could achieve the necessary sales to be profitable. A fact that would have made their financial controllers and institutional investors uncomfortable.

Currently, Tesla dominates the competition as the most valuable car company in the world. Indeed, Tesla have made incredible progress towards their goal of mass-produced affordable electric cars. In 2022, Tesla’s gross revenue rose by half to $115 billion (AUD), while net profit more than doubled to $17.7 billion (AUD). Despite an incredibly difficult period that included forced shutdowns, high interest rates and working within a challenging global supply chain.

Their unconventional strategy has worked, and let’s find out how that happened.

Tesla’s Three Lessons

Firstly, most of Tesla’s business strategy was forced upon it since there was no way that any company could have created a cost-effective mass-market electric car without creating economies of scale. Additionally, because their market niche was so unique, producing an affordable electric car, they couldn’t rely on outsourcing or partnerships to obtain economies of scale.

This business strategy was strengthened through their supply chain management, which was particularly astute, as they knew that batteries were both the largest technological hurdle and the biggest production bottleneck facing production. Tesla dealt with problem directly by constructing and operating battery factories in Nevada, California, New York, Berlin, and Shanghai. These locations also coincide with their potential geographic marketplaces reducing supply chain problems. Another positive externality is that these same batteries are used in parallel business ventures such as the Powerwall.

To paraphrase Obi Wan Kenobi ‘this is an elegant solution for a post-industrial society.’

The best comparison to this was the US Navy in the 1920s and 30’s sponsoring locomotive diesel battery research and development. This created a larger market for batteries allowing economies of scale and greatly sped up battery development. These same batteries then powered the US Navy Submarine fleet that wreaked havoc in the Pacific campaign during WW 2.

Finally, this is where the marketing sophistication of Tesla starts, except that the advertisements were only partly about the cars. Rather, it was Elon Musk’s personal brand as an eccentric successful businessman that helped Tesla obtain the investment they needed. Putting aside your personal opinions about Elon Musk, he remains incredibly well known either on the front page, back page or on a webpage, and that’s a great recipe for getting investors’ attention.

Final Thoughts

Tesla’s strategy of playing the long game required vast quantities of capital and outside fundraising. Which shows how capital intensive this venture was to begin with and explains why no other company had moved into the space earlier.

Ultimately Tesla was successful due to having deep pockets, understanding the potential of the market, identifying the key bottleneck, and dealing with it directly and playing to their strengths.