The potential for an American recession has increased with the Federal Bank’s interest rate hikes over 2022 and, it’s negative impact on share prices. This makes it likely that the American economy will experience a recession during 2023.

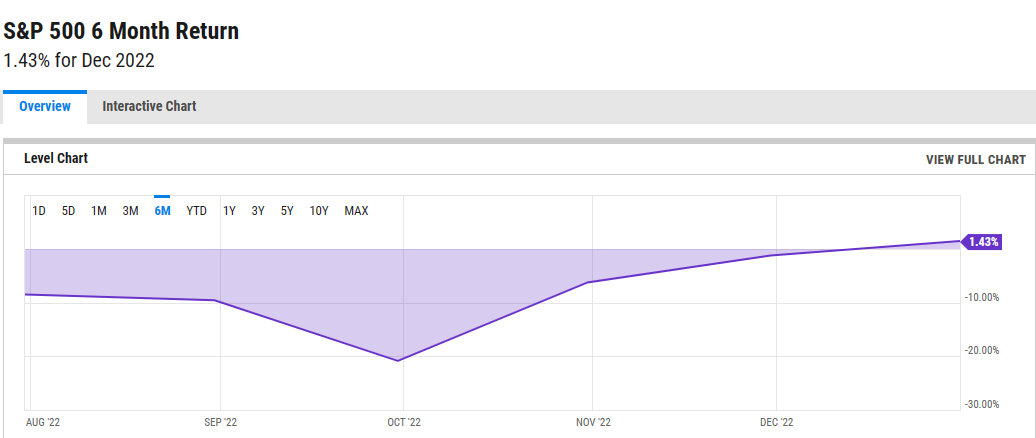

If we look at the bond market, which usually provides the best indicator, then the market has priced in a recession during late 2023 / early 2024 based on short versus long term yield curves. While the stock market also points to a higher recession risk, except it anticipates one occurring during early 2023. The 6-month S & P 500 chart from Y charts below, shows the index’s subdued performance during this period.

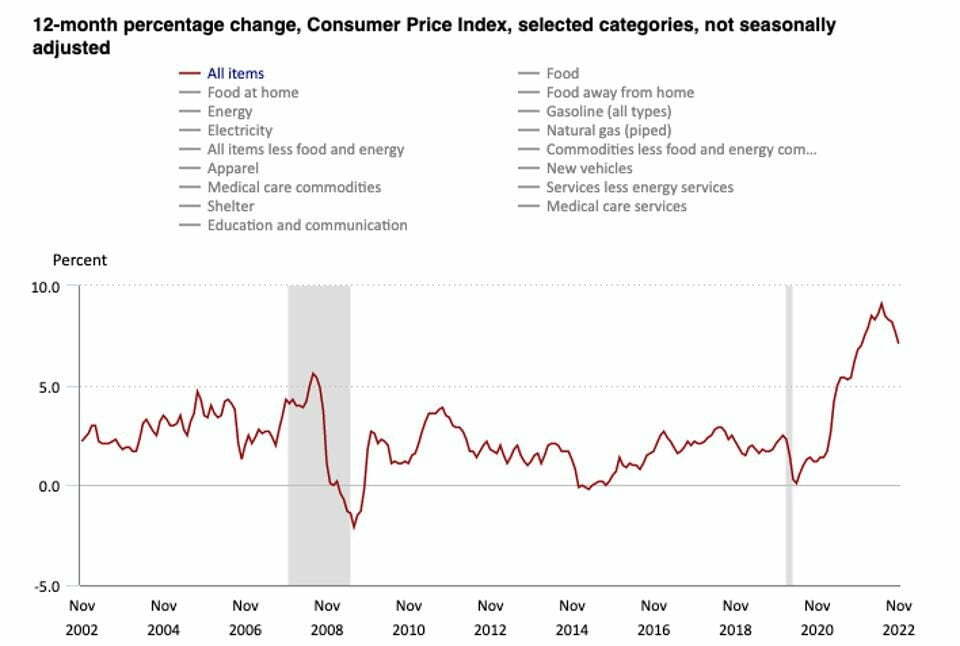

The chart below, taken from the US Bureau of Labour website, shows the sustained period of inflation experienced by the American economy in 2022, despite the consecutive interest rate rises by the Federal Bank. Which has the country still experiencing comparatively higher levels of inflation.

While the National Federation of Independent Businesses recently disclosed their December 2022 Small Business optimism index. Their members are downright pessimistic due to sustained inflation, supply chain disruption and the perennial issue for small businesses finding quality talent. Now, small businesses within America contribute around 2/3rds of all employment opportunities and around 40 % of overall economic activity. Which when considered with the stock and bond market performance, certainly gives weight to holding a bearish outlook.

What would a recession look like?

Firstly, no two downturns are ever the same. While inflation has trended downwards since June 2022 on the back of seven interest rate rises, it is likely to remain elevated for longer due to strong consumer demand and COVID related supply chain issues.

The main points from past recessions during periods of high inflation are:

- High inflation recessions last on average around a year, which tends to be longer than their low inflation counterparts.

- Unemployment acts as a bellwether to mark the start and the end of the recession. Although there tends to be little difference between unemployment rates during high and low inflation recessions.

- Core inflation falls more during high inflation recessions, as consumer demand falls into a trough roughly three years after the start of a contraction.

- The Federal Reserve starts cutting interest rates prior to a sustained increase in unemployment, although that pattern is harder to determine during periods of high inflation.

- 10 year government bonds tend to peak at the start of a high inflation recession and stock prices will fall sharply during a recession. Both trends are more observable during high inflation periods.

With that in mind carefully watch the stock market and bond rate. If the short-term bond yield drops, in conjunction with the share market decreasing in value. Followed by the Federal Reserve either holding or cutting interest rates, then it is likely that these events will announce the start of an American recession.

An event that would not only have economic repercussions, but likely a political impact as well in the lead up to the 2024 Presidential election.