On 25 October, the Federal Labor government handed down their first budget since gaining office in May. While the government was at pains to stress that the budget’s intention was to highlight the state of the nation’s finances. The treasurer Dr Jim Chalmers, also an alumni of my undergraduate alma mater Griffith University, started proceedings with a bang. By warning that the world faced the prospect of a third global downturn in a decade and a half.

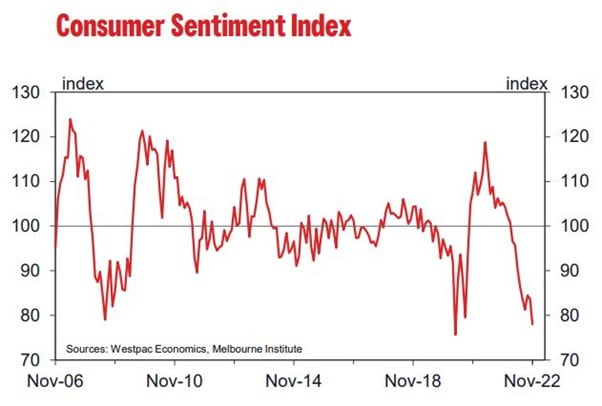

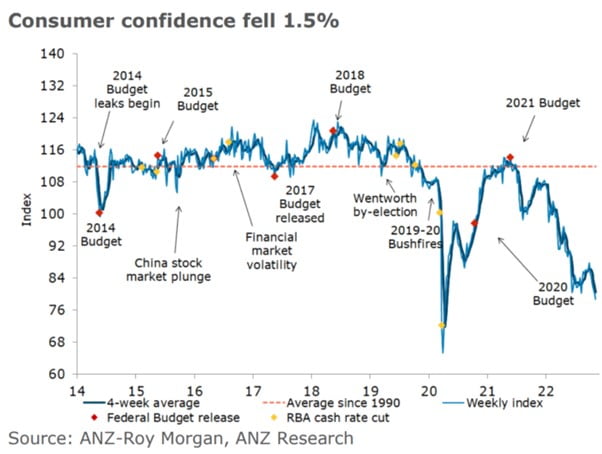

Firstly, do households share the treasurer’s gloomy outlook? The answer from the latest consumer sentiment indexes is a clear yes to an almost recessionary level. I’ve attached the latest Westpac & ANZ – Roy Morgan surveys that show their findings below.

As you can see consumer sentiment has fallen to 78.0, suggesting that consumer spending is slowing as rising inflation and interest rates weigh heavily on family finances. Indeed, consumers are so pessimistic that the November result is lower than the measure recorded during the Global Financial Crisis and broadly comparable to the results recorded during the 1990 recession.

An outcome of the depressed consumer outlook is that nearly 40% of consumers intend to cut Christmas spending, while house price confidence heads towards 2018/19 lows. The impact of consumers keeping their wallets shut is likely to be felt by retailers given their reliance on Christmas spending to pad out their bottom lines.

One of the reasons behind consumer gloominess revolves around the impact of cost of living on middle Australia. Particularly as the Reserve Bank of Australia (“RBA”) raised interest rates in November for the seventh straight month. With inflation expected to peak at 8% in December, the RBA is likely to continue hiking rates into 2023.

Interest rates are a blunt instrument, and their impact is lagged. So, the Australian economy won’t feel the full impact of the latest interest rate rises upon discretionary spending until early 2023. Although, households are apparently setting funds aside to deal with the expected increase to mortgage repayments, which suggests that consumer spending will trend lower for the rest of 2022.

While there have already been several articles about the budget, let’s look at shelter specifically households that rent. According to the 2021 Australian Bureau of Statistics census, renters constitute some 1/3 of the Australian housing market.

CoreLogic’s latest housing market summary below, shows that Australia’s rental market continues to deteriorate. With vacancies and listings hitting fresh lows, and rents rising above inflation. Total rental listings across the combined capital cities have also hit their lowest level in at least a decade.

The budget included an assumption that immigration would be raised above 500k. While not all immigrants will rent, indeed some will purchase dwellings upon arrival. The sheer quantum of people arriving and competing within an already tight rental market, will ultimately worsen the current rental squeeze. Which will cause a further decrease in household spending, as renters spend more of their household budget to keep a roof over their heads. While mortgage holders will also need to allocate more of their budget to service their mortgages.

While the budget included a provision for a million new homes to be constructed over the next five years, this is unlikely to improve the situation faced by renters in the short to medium term. All in all, consumers have every right to be gloomy, as the rental and the energy market continue to deteriorate in 2023.